Bookkeeping

On this page:

Please note: We are currently near capacity and only accepting new clients on a limited basis.

Please click the link below to fill out a short questionnaire and a staff member will contact you if capacity is available.

At Accountants on the Go, we encourage you to maintain as much of the day to day bookkeeping as you feel comfortable doing. We can teach you and your staff how to do this and we will be happy to review your Quickbooks setup, chart of accounts, and other details.

There are several important benefits to this…

Since we are not doing extensive data entry on your behalf — you will save money. Also we will be able to complete your bookkeeping reports and file your returns faster. But most importantly, taking some of the mystery out of the bookkeeping process gives you peace of mind and allows you to keep your finger on the financial pulse of your business.

Client Upload Form – Bookkeeping

New Business Setup

Steps to establishing a new business:

- Open a Bank Account: Take your Articles of Organization from the Secretary of State, and your EIN from the IRS, and open a new separate bank account.

Request for Taxpayer Identification Number (W9)

Quickbooks Setup

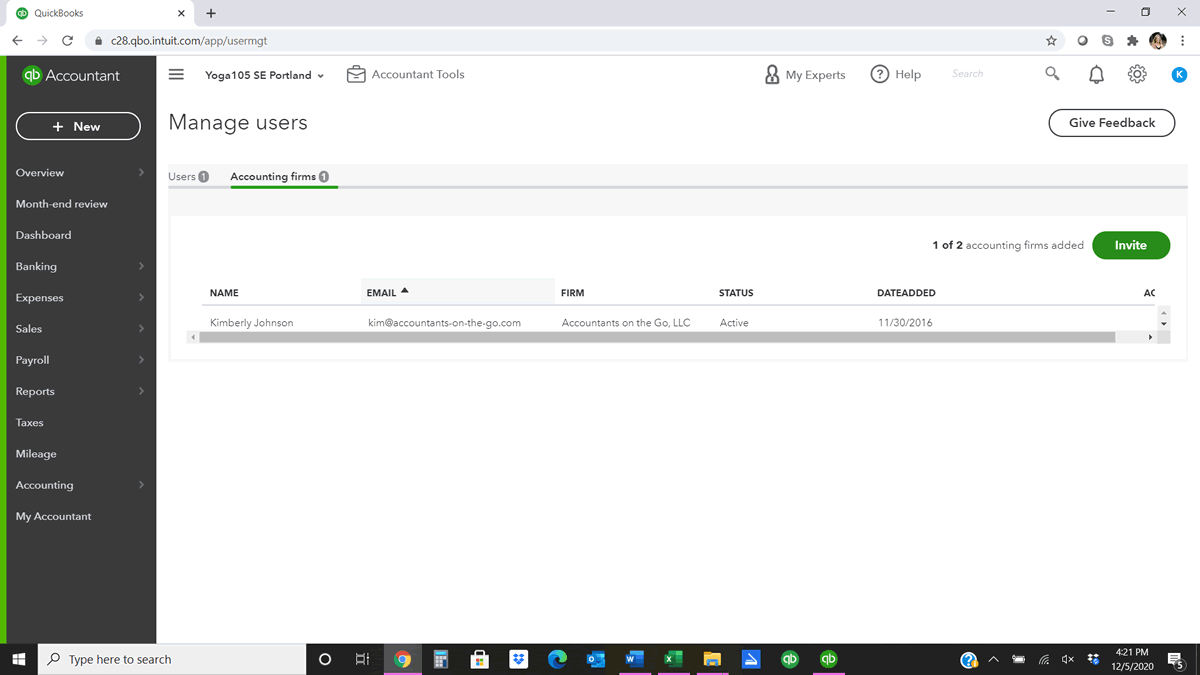

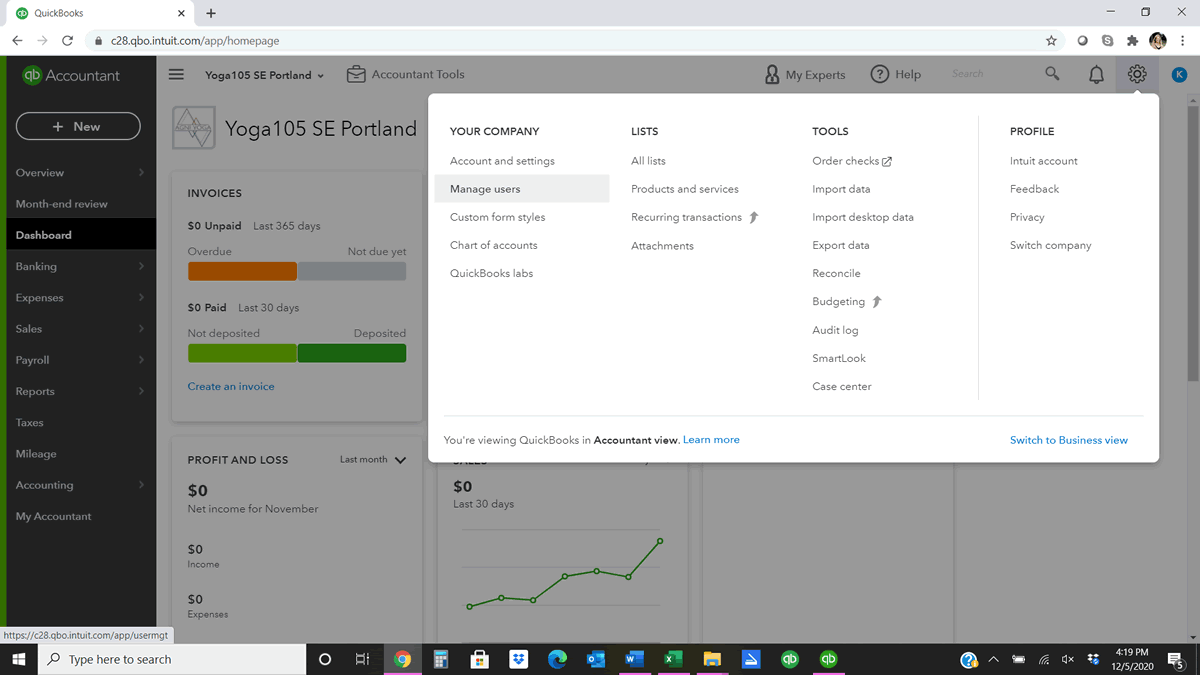

Here are steps for “adding an accountant” to your Quickbooks Online

- Sign in to your QuickBooks Online.

- Click on the Gear Icon > Manage Users.

- Go to the Accounting Firms section.

- Enter your accountant’s email address (kim@accountants-on-the-go.com) and first and last name (Kim Johnson).

- Click Invite. They will receive an email with a link for signing in to your company.

- They will be asked to create a user ID before signing in the first time unless they already have an account with Intuit Business Services.

- Until your accountant signs in, their status on the Manage Users page is “Invited.” After accepting the invitation, their status changes to “Active.”

- Click Next and Finish.

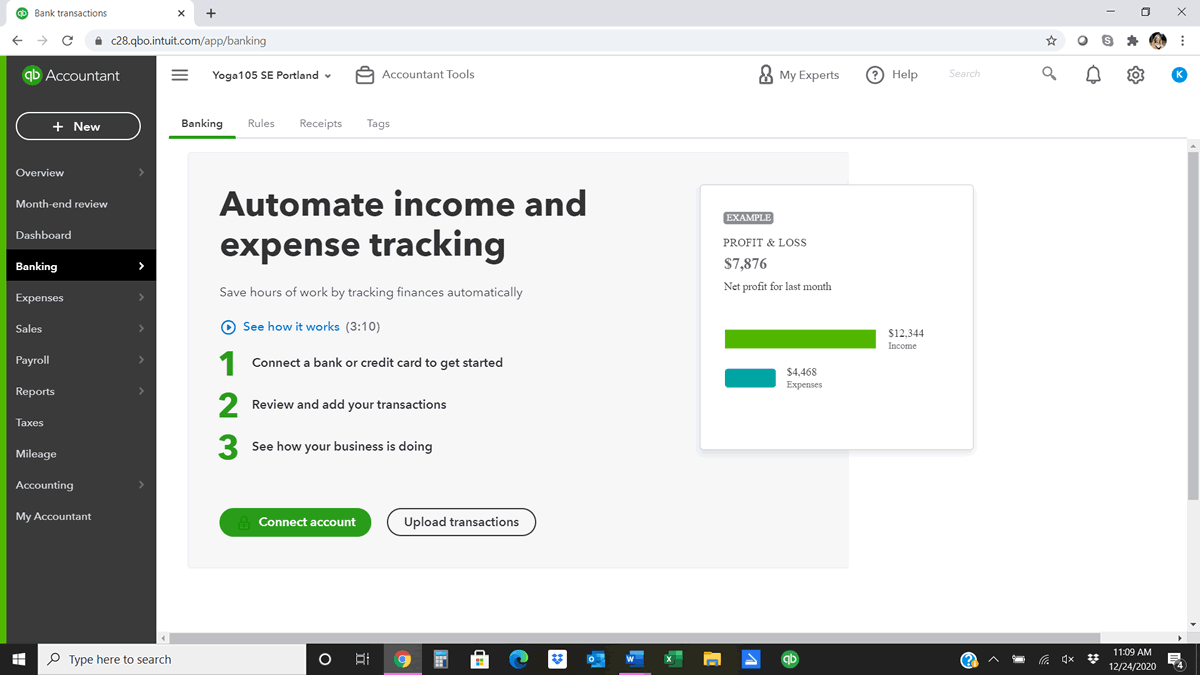

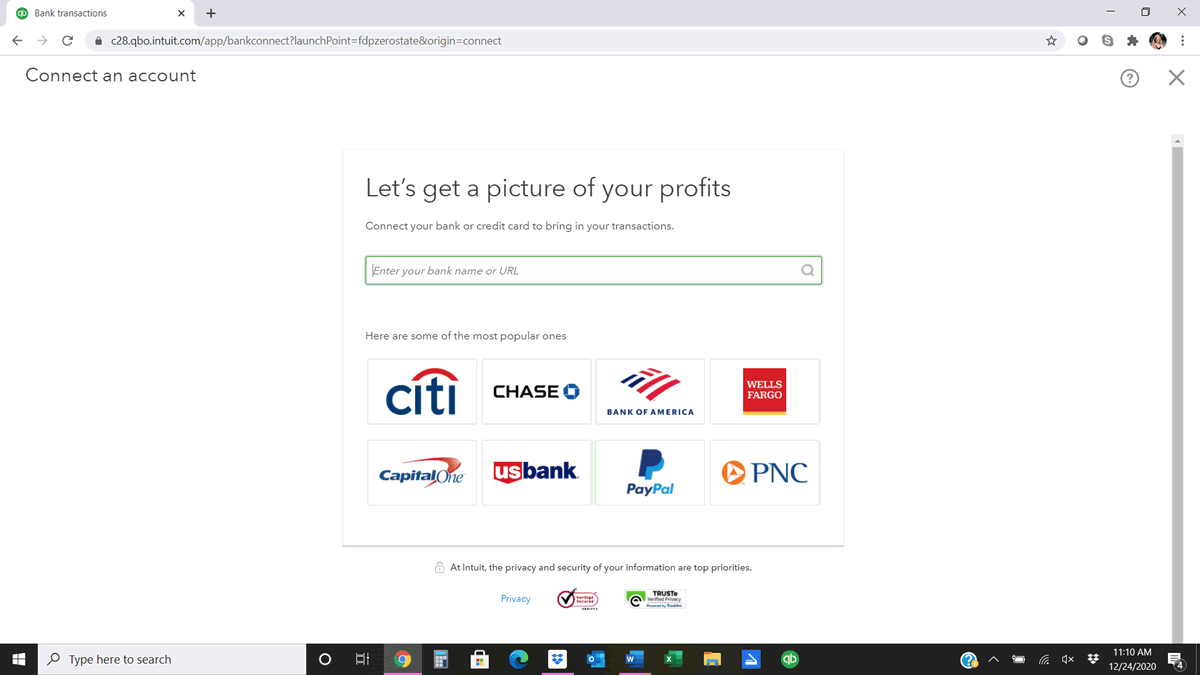

How to add a bank account in Quickbooks Online

- Select Banking from the left menu.

- Click Add Account.

- Search for your bank or use the correct URL when you log in to your bank’s website.

- Enter your bank’s username and password.

- Select the type of account.

- Select how far back you want to download bank transactions.

- Click Connect.

Election of S Corporation

Below are the IRS forms required to request S Corporation status for your business.

If you are currently registered with the State of Oregon as a Domestic Limited Liability Company, you will need to complete both Form 8832 and Form 2553 in order to request S Corporation status.

If you are already registered with the State of Oregon as a Domestic Business Corporation, you will only need to complete Form 2553 to request S Corporation status.

Please allow up to 60 days for the IRS to respond. Once you have been approved, you will need to begin running payroll for yourself as the Owner/Officer of the corporation. Please see our payroll page for more information about setting up payroll.

If you need help completing these forms, or would like to further discuss the advantages of becoming an S Corporation, please contact our office or use our on-line calendar to schedule an appointment.